Limited Cost Trader

The Autumn statement announced changes that may impact your business. Specifically, businesses using the Flat Rate VAT (FRV) Scheme, or thinking about using it, will need to assess whether they meet the definition of a Limited Cost Trader (LCT); and if you do, then you will need to apply a higher rate percentage which may mean that moving to a normal VAT scheme or deregistering (if applicable) makes more sense. The Chancellor sees these changes as ‘tackling aggressive abuse of the VAT Flat Rate Scheme’.

What is the higher percentage?

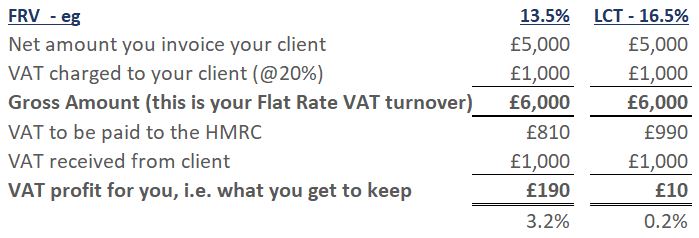

Currently businesses determine which FRV percentage to use by reference to their trade sector. The proposed revisions will mean that if you are deemed a LCT, you will need to apply 16.5% regardless of your sector. The implications of the higher rate mean that it probably no longer makes sense to be registered in the FRV scheme, for example:

Example of FRV @ 13.5% vs LCT

What is a Limited Cost Trader (LCT)?

Basically, a Limited Cost Trader is deemed as one that spends less than 2% of its VAT inclusive turnover; or greater than 2% of turnover, but less than £1000 per annum on goods (not services) in an accounting period.

When working out the amount spent on goods, it cannot include purchases of:

* Capital goods (such as new equipment used in a business)

* Food and drink (such as lunches for staff)

* Vehicles or parts for vehicles (unless running a vehicle hiring business).

To complicate things further – there are transitional measures!

By introducing these transitional measures, the HMRC is trying to tackle businesses who pay or invoice in advance to avoid the higher rate of tax being implemented with the new legislation. They are called “anti-forestalling provisions” and are there to stop a company trying to avoid the higher VAT rate (through invoicing before 1 April, for example).

When do the changes officially commence?

The changes came into effect from 1 April 2017.