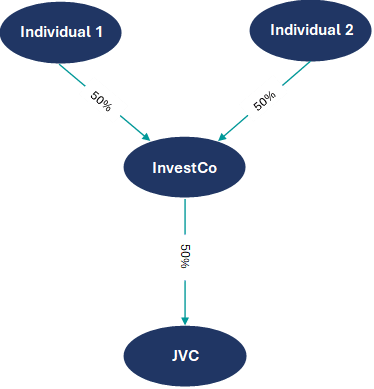

A company is called a joint venture company (JVC) if its shareholders hold 50% or less of its shares and voting rights. (It would be called a subsidiary of a holding company if its shareholder held more than 50% of the shares and voting rights.) The Investing Company (InvestCo) is the shareholder of the JVC. The structure could look like this:

The Question:

Can the individuals claim Business Asset Disposal Relief (BADR) if the investing company disposes of its shares in the JVC?

The Answer:

Yes, but InvestCo will need to be liquidated, and the following conditions will need to be met:

- The conditions for attributing the activities of the JVC to the InvestCo, and

- The normal BADR conditions

Why must InvestCo be Liquidated?

BADR applies only to individuals, not companies. So, if a personal company owns shares in a trading company, and then sells those shares, the gain belongs to the company, not the individual. To get the gain into the hands of the individual, the personal company needs to be liquidated/closed, and the gain passed on via a capital distribution. At that point, the individual pays Capital Gains Tax (CGT) on the distribution and can claim BADR, assuming all other conditions are met. (note: InvestCo might qualify for a tax exemption on the gain - see SSE link further down)

Attribution of Activities of a Joint Venture Company

The trading activities of a JVC can be treated as activities of InvestCo if certain conditions are met. https://www.gov.uk/hmrc-internal-manuals/capital-gains-manual/cg64083

This allows individuals to qualify for Business Asset Disposal Relief (BADR) on a disposal of BADR joint venture shares held through their personal company (InvestCo), even if their interest in the trading company (JVC) is held indirectly.

The conditions are that throughout the qualifying period of two years prior to either the disposal of shares, or the date the TradeCo ceased to be trading, the individual must hold the following in the JVC (either directly or indirectly):

- 5% or more of the ordinary share capital, and

- 5% or more of the voting rights

What is the Qualifying Period?

The qualifying period runs up to the date the investor’s interest in the company’s trading activity comes to an end. This can happen either when:

- The company ceases to trade (so TradeCo is liquidated), or

- The shares in the trading company are sold (so TradeCo continues to trade, but with new owners).

What are the Normal BADR Conditions?

See this link for details: Business Asset Disposal Relief (BADR) Qualifying Conditions

Take note that in the case of a JVC, the condition for the individual to have been an employee or director (office holder) of the company is met if the individual was an employee or director (office holder) of InvestCo (it does not matter if they are not an employee or director of the JVC - this would not disqualify this condition).

Other Considerations

InvestCo might qualify for Substantial Shareholdings Exemption (SSE) – for more information on SSE, visit this link: Substantial Shareholdings Exemption (SSE): A Brief Summary and Step-by-Step Guide

Holding Company or Venturer vs Investment Company: What’s the Difference?

In summary, individuals may be eligible to claim BADR on BADR joint venture shares, provided the necessary conditions are met and the investing company is properly liquidated. This ensures the gain is passed on to the individual and taxed under Capital Gains Tax with potential relief.

While every care and attention has been taken to ensure the accuracy of the information contained in this publication, it has been prepared in general terms and does not constitute advice. It should only be regarded as general guidelines. The information may change over time and is not a substitute for professional advice. Users are encouraged to verify the information independently or consult one of our qualified professionals at EOACC LTD for specific guidance. Any liabilities or losses arising, or enquiries raised by HM Revenue and Customs or any other parties, due to the taking or refraining of actions referred to in this publication are not the responsibility of EOACC LTD.