Interest on Buy-To-Let Mortgages

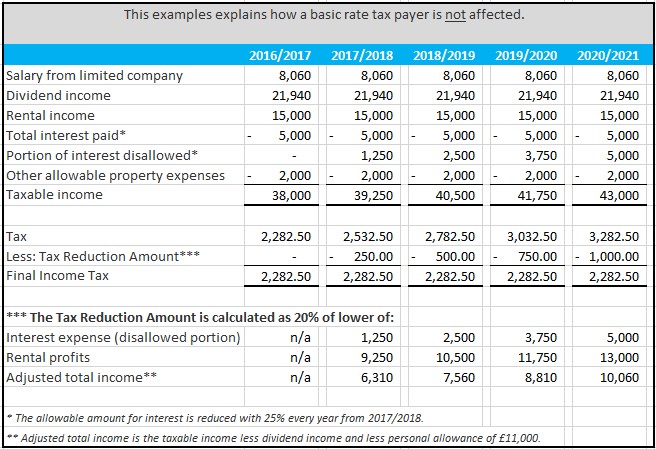

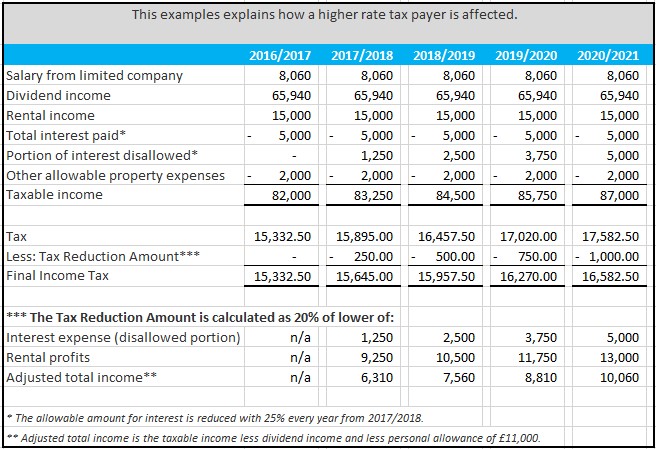

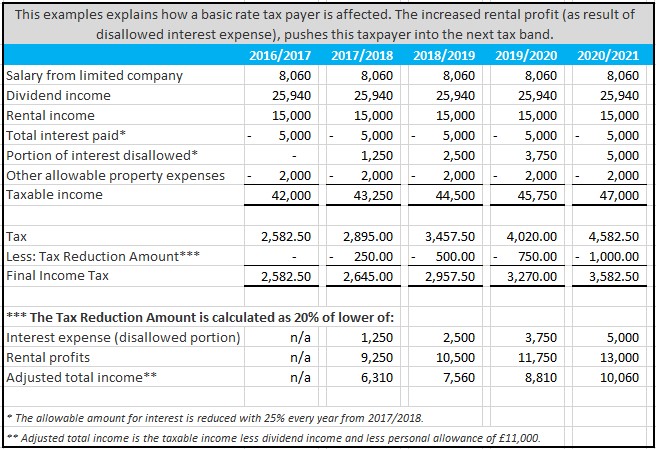

From 6 April 2017 full interest expenses can no longer be deducted from rental income, a Tax Reduction Amount must be calculated instead. The tax liability of a basic-rate taxpayer could remain unchanged, if the new profit calculation does not push the basic-rate taxpayer into a higher tax band.

This does not apply to:

- UK resident companies

- Non-UK resident companies

- Landlords of Furnished Holiday Lettings

Points to note:

- Consider the implication to High income child benefit charge (HICBC) if dis allowance of interest expense pushes taxable income over the £50k threshold.

- The Tax Reduction Amount cannot create a tax refund.

- Any ‘unused’ interest expenses are carried forward, and added to future interest expenses.

EXAMPLES:

Using the 2016/17 rates throughout, for simplicity. And assuming only one property business.