The Digital Economy Act 2017 gave the government…

Dividend Tax changes 2015

Changes to Dividend tax April 2015

You’ve probably heard about the introduction of the new Dividend Tax from 6 April 2015. It’s certainly becoming more difficult to do manual tax planning with these new changes. In summary, if your only earnings are a small salary and dividends from a limited company, you will pay up to about £2k tax on net dividends under the higher rate threshold. This tax will only be due by January 2018. On net dividends exceeding the higher rate threshold, you will pay an additional 7.5% (new rate of 32.5% less current rate of 25%). Additional taxes apply on income over the £100k and £150k thresholds.

What is changing?

From 6 April 2016 dividends will be taxed differently:

* The 10% notional tax credit will be abolished. The effect of this is that dividends will no longer be grossed up in the personal tax computation and therefore more dividends can be earned within the basic rate band.

* There will be a Dividend Tax Allowance of £5k, i.e. the first 5k taxable dividends** will be tax free.

* Taxable dividends over £5k and under the higher rate threshold (£43k for 16/17) will be taxed at 7.5%.

* Dividends in the higher rate band (between £43k and £150k for 16/17) will be taxed at 32.5%.

* Dividends in the additional rate band (£150k+) will be taxed at 38.1%.

** Taxable dividends are those exceeding the personal allowance (£11k for 16/17).

Examples to explain taxable dividends:

- If your only income is £20k dividends, then your taxable dividends will be £9k (i.e. £20k less £11k personal allowance for 16/17); but the first £5k are tax free, so you will only pay tax on £4k dividends at basic rate (7.5%).

- If you have a salary of £8k and dividends of £30k, then your taxable dividends are £27k (i.e. £8k + £30k less £11k personal allowance); but only £22k (i.e. £27k less £5k dividend tax allowance) will be taxed at basic rate (7.5%).

- If you have a salary of £8k and dividends of £42k, then your taxable dividends will be £39k (£8k + £42k less £11k personal allowance); £5k of this falls within the dividend tax allowance; £27k (£43k higher rate threshold less £11k personal allowance less £5k dividend allowance) will be taxed at basic rate (7.5%); and £7k (£50k total earnings less £43k higher rate threshold) will be taxed at higher rate (32.5%).

How will this affect me?

That depends on what dividend and non-dividend earnings you have.

* If your dividend income is less than your non-dividend income, and you are a higher or additional rate payer, then you’ll probably pay less tax (because you get £5k dividend tax allowance).

* If your dividends are the majority of your income, then you’ll pay more tax than you used to.

Are there any advantages to the new tax on dividends?

Not much, but there are some advantages. Because dividends will no longer be grossed up, you will be able to:

* earn more dividends in the basic rate band, which will be taxed at 7.5% rather than the current 25% in the higher rate band;

* earn more dividends before reaching the £50k threshold after which the High Income Child Benefit Tax Charge applies;

* earn more dividends before reaching the £100k threshold after which personal allowance is progressively withdrawn (at a rate of £1 for every £2 above £100k).

Will it still be worth it to trade through a limited company?

Most definitely:

* Dividend tax at basic rate is still lower than NIC rates payable when self-employed or permanently employed;

* Dividend tax is calculated on profits after tax from your limited company, whereas in permanent employment PAYE/NI is calculated on gross earnings;

* Contractors usually are paid better rates than permanent employees;

* You can claim expenses that are business related; please follow http://www.eoacc.com/services/contractors-and-freelancers for our expenses guide;

* You can take advantage of entrepreneurs’ relief if you have retained earnings when closing your company. Please read http://www.eoacc.com/blog/entrepreneurs-relief-for-contractors for more info.

* You can profit from the Flat Rate VAT Scheme;

* You still have the flexibility to structure your personal earnings to be most tax efficient for you (e.g. if you have other income outside of your limited company, like rental income, you can choose to earn less from your limited company in order not to exceed a threshold).

I have some retained earnings in my company, should I declare the dividends before 5 April 2016?

That’s a tricky question and depends on what your non-dividend income is and how much dividends you want to declare. I’ve assumed the following for all my examples below:

2015/16 2016/17

Salary (optimal for 14/15): £8,060.04 £8,060.04*

Personal Allowance: £10,600 £11,000

Basic Rate Limit: £31,785 £32,000

Higher Rate Threshold: £42,385 £43,000

Other non-dividend income: Nil Nil

* At the time of compiling the list, the optimal salary for 16/17 was not available.

When looking at these examples, please bear in mind that from 6 April 2016 you will be taxed on dividends at basic rate. This is a new tax you did not have to pay before. This 7.5% dividend tax at basic rate should not influence your decision on which year to rather take out dividends. If you’ve always taken dividends up to the higher earnings threshold, you’ll continue to do so, you’ll just have to pay tax on those dividends from 6 April 2016. You’ll also be able to take out more dividends within the basic rate limit from 6 April 2016.

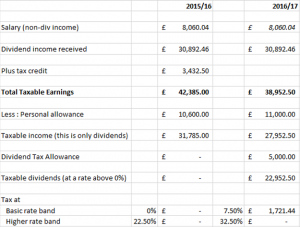

Example 1

Net dividends of £30,892.46 will give you total taxable earnings of £42,385 (higher rate threshold) in 15/16 and £38,952.50 in 16/17. In 15/16 you don’t pay any dividend tax because you’ve earned the dividends within the basic rate limit. In 16/17 you pay dividend tax at basic rate (7.5%); in this example that will be £1,721.44 (£38,952.50 less £11k less £5k x 7.5%). But you can earn £4,047.50 (£43k less £38,952.50) more dividends in 16/17 before reaching the higher rate threshold. These additional dividends are taxed at basic rate (7.5%) in 16/17, but at higher rate (25%) in 15/16. So, if you usually pay yourself dividends up to the higher rate threshold, and you only want to take out about £4k more, then it would be better to take it after 5 April 2016.

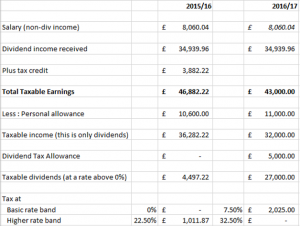

Example 2

Following on from example 1, if you would pay the extra dividend of £4k, so a net dividend of £34,939.96 in both years, your total taxable earnings in 15/16 would exceed the higher rate threshold, whereas in 16/17 it would be £43k (higher rate threshold). In 15/16 you pay tax at the higher rate (25%) on the additional £4k dividends (i.e. dividend tax of £1,011.87); in 16/17 you pay dividend tax at basic rate (7.5%) on the £4k (i.e. £303.56). Therefore, you pay £708.31 less tax in 16/17 on the additional £4k dividends.

Example 3

If you would pay dividends of £40,000 in both years, then even though total earnings in both years exceed the higher rate threshold, a lesser amount is taxed at higher rate in 16/17 than in 15/16 (that is because dividends won’t be grossed up in 16/17). In this example you would pay £632.37 less dividend tax at higher rate in 16/17 than in 15/16.

Example 4

With net dividends of £48,430 the dividend tax at higher rate is similar in both years. In this example it would be about £4,384 dividend tax. Remember that in 16/17 you also have to pay dividend at basic rate, which is £2,025. This level of dividend is about the turning point in our examples, where any more dividends earned will be taxed higher in 16/17 than in 15/16.

Example 5

Net dividends of £82,745.96 will give you a total gross earning of £100k in 15/16. You would normally try to avoid paying yourself more dividends to avoid losing your personal allowance. With this level of dividends, the tax you pay at higher rate is £12,963.38 in 15/16 and £15,536.95 in 16/17. Remember that in 16/17 you also have to pay dividend at basic rate, which is £2,025. Also bear in mind that with this level of dividends your total gross earnings in 16/17 will only be £90,608, so you can earn another £9,392 before reaching the £100k threshold.