The new Chancellor of the Exchequer, Rachel Reeves,…

Dividend Tax changes – April 2016

Dividend tax changes affecting you?

If you are a limited company contractor or if you have a business that you run through a limited company, then the new dividend tax effective from 6 April 2016 will definitely affect you.

What is changing?

* Tax on dividends will increase with 7.5%

* The first £5,000 taxable dividends are tax free.

* The 10% notional tax credit will be abolished, so no more net and gross dividends, there will only be one amount.

How will the changes affect you?

* Overall you will be worse off the next tax year compared to this tax year. But you will still be better off than permanent employment or an umbrella company.

* You will be able to take out about £4k more dividends in 16/17 before starting to pay higher tax. If you only pay up to the higher earnings threshold (£43k in 16/17), you’ll have about £2k more cash in your pocket after tax.

What can you do about the changes?

Below we’re going to discuss a few different situations. Hopefully you can slot your situation into one of them.

Please note that the examples (as well as any other amounts mentioned in this blog) assume a salary of £8,060, which is the most tax efficient salary for both tax years (15/16 and 16/17). And any other personal income/expenses are ignored.

If your total earnings are always under the higher rate threshold (£42k)

All you need to do is make sure that at 5 April 2016 you have declared all the dividends you possibly can to take advantage of the tax-free dividends.

And then you must be aware that from the 16/17 tax year you will probably have a personal tax bill of up to £2,025 (due by January 2018). So, make sure to budget for this.

If your total earnings are on the higher rate threshold (£42k), and you have retained earnings in your company, and you don’t have any plans to close your company within the next 3 years

If you’re not going to close your company any time soon, then you might be better off taking the retained earnings out of your company. We discussed this in detail in our blog on how to reduce your tax bill and pay yourself as effectively as possible.

If you’re considering taking some/all of your retained earnings out of your company, the question you want answered is whether you should take it before 5 April 2016 or after. The answer depends on the amount of retained earnings in your company and the amount you want to take out. I will explain this with examples below. If you’re interested in the detailed calculations, you can find it in our other blog on dividend tax.

If your total personal earnings have never exceeded the higher rate band (£42k), then you’re probably not used to having a personal tax bill. You need to be aware that from the 16/17 tax year, you will have a personal tax bill of at least £2,025 (due by January 2018). So, make sure to budget for this.

Example 1: Jack earns dividends at the 15/16 higher rate threshold (i.e. the maximum dividend amount at 0% tax). If he takes out the exact same amount in 16/17, he will have to pay dividend tax of £1.7k. This is at 7.5% on taxable dividends, which is still lower than the NI charge on permanent earnings. He cannot avoid this, unless he declares almost no dividends at all, which would not make any sense.

Example 2: Sarah earns the same as Jack above, but she has about £4k retained earnings in her company which she wants to declare as dividends. She wants to know whether she should take the dividends in 15/16 or rather in 16/17. If she takes it in 15/16, she will pay 25% tax on the £4k. If she takes it in 16/17, she will only pay 7.5% on the £4k, since it is still under the higher rate threshold (£43k) for 16/17. So, she’ll be better off taking the £4k extra dividends in 16/17.

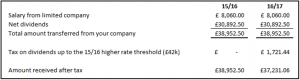

Example 3: Kevin is in the same situation as Sarah above. The only difference is he has about £9k retained earnings. If he takes it in 15/16, he will pay 25% tax on the £9k. If he takes it in 16/17, he will pay 7.5% on the first £4k and 32.5% on the remainder. As you can see from the calculation below, the total tax on the additional £9k dividends is less in 16/17 than in 15/16, so he’ll be better off taking the £9k extra dividends in 16/17.

Example 4: Lisa is in the same situation as Kevin above, except that she has about £13.5k retained earnings. The tax rates are the same as in example 3, but if you look at the tax on the additional £13.5k dividends, then you’ll see that there’s hardly any difference between the two years. So, looking purely at the tax charge, it won’t make any difference in which year she takes the extra £13.5k dividends.

Example 5: Cathy is also in the same situation as Kevin above, except that she has about £23.1k retained earnings. The tax rates are the same as in example 3, but if you look at the tax on the additional £23.1k dividends, then you’ll see that it is more in 16/17 than in 15/16. So, she’ll be better off declaring the extra £23.1k dividends in 15/16, rather than in 16/17.

Example 6: Dan is also in the same situation as Kevin above, except that he has about £51.8k retained earnings. The tax rates are the same as in example 3, but if you look at the tax on the additional £51.8k dividends, then you’ll see that it is approx. £2,877 more in 16/17 than in 15/16. So, he’ll be better off declaring dividends up to the £100k threshold in 15/16, rather than in 16/17.

From the examples above, you will see that £13.5k retained earnings is the turning point. Any additional dividends declared over and above the basic amount of £30,892.50 (as per example 1) and exceeding £13.5k will be taxed higher in 16/17 than in 15/16, as per our examples. But please note that the difference between the two years is not massive for retained earnings up to approx. £23.1k (see Example 5) – it’s about £700 at the most. So not worth breaking your head about. If you have closer to £30k/more retained earnings, then you should consider declaring dividends up to the £100k threshold before the 5th of April, because you could potentially be better off by up to £2,877.

If your total personal earnings usually exceed the higher rate band (£42k), but are below approx. £62k, and you don’t have any plans to close your company within the next 3 years

You can probably continue declaring the same dividends as you always have. But you could also have a look at the examples above, to see if you might want to defer declaring dividends, or declare more in 15/16.

If your total personal earnings are usually between approx. £62k and £100k, and you don’t have any plans to close your company within the next 3 years

All you need to do is make sure that at 5 April 2016 you have declared all the dividends you possibly can to take advantage of the current dividend tax rate of 25%.

We don’t advise exceeding the £100k threshold though, since your personal allowance will be withdrawn progressively at a rate of £1 for every £2 exceeding the £100k threshold. Please discuss this with us if you need to take more dividends.

If you have retained earnings in your company and you are considering closing your company in the next 3 years

Please discuss with us. Depending on your situation, we might recommend you don’t exceed the higher rate threshold (£42k/£43k) in any year, and then take advantage of the generous tax saving available when claiming Entrepreneur’s Relief. Please bear in mind that from 6 April 2016, Entrepreneur’s Relief cannot be claimed if you continue with a similar trade or activity within two years of winding-up your company.

Closing note

This topic is very complicated, but we’ve tried to make it as simple as possible in this blog and we hope it has helped you understand the new dividend tax a little better. If you want to know more or need more detail, you can find this in our other blog on dividend tax. You can also contact us anytime if you have any questions at all.

We will assist all our gold/silver clients with personal tax planning; this is included in our monthly fee packages. If you’re not on one of our packages, and you would like us to review your unique situation, then please feel free to contact us. Either way, please complete the questionnaire at the bottom of our blog ‘How to reduce your tax bill and pay yourself as effectively as possible’ and email your answers to us so we can advise you accordingly.